An Unbiased View of Simply Solar Illinois

An Unbiased View of Simply Solar Illinois

Blog Article

Fascination About Simply Solar Illinois

Table of ContentsSimply Solar Illinois Fundamentals Explained8 Easy Facts About Simply Solar Illinois DescribedSimply Solar Illinois for BeginnersThe smart Trick of Simply Solar Illinois That Nobody is Talking AboutThe Best Guide To Simply Solar Illinois

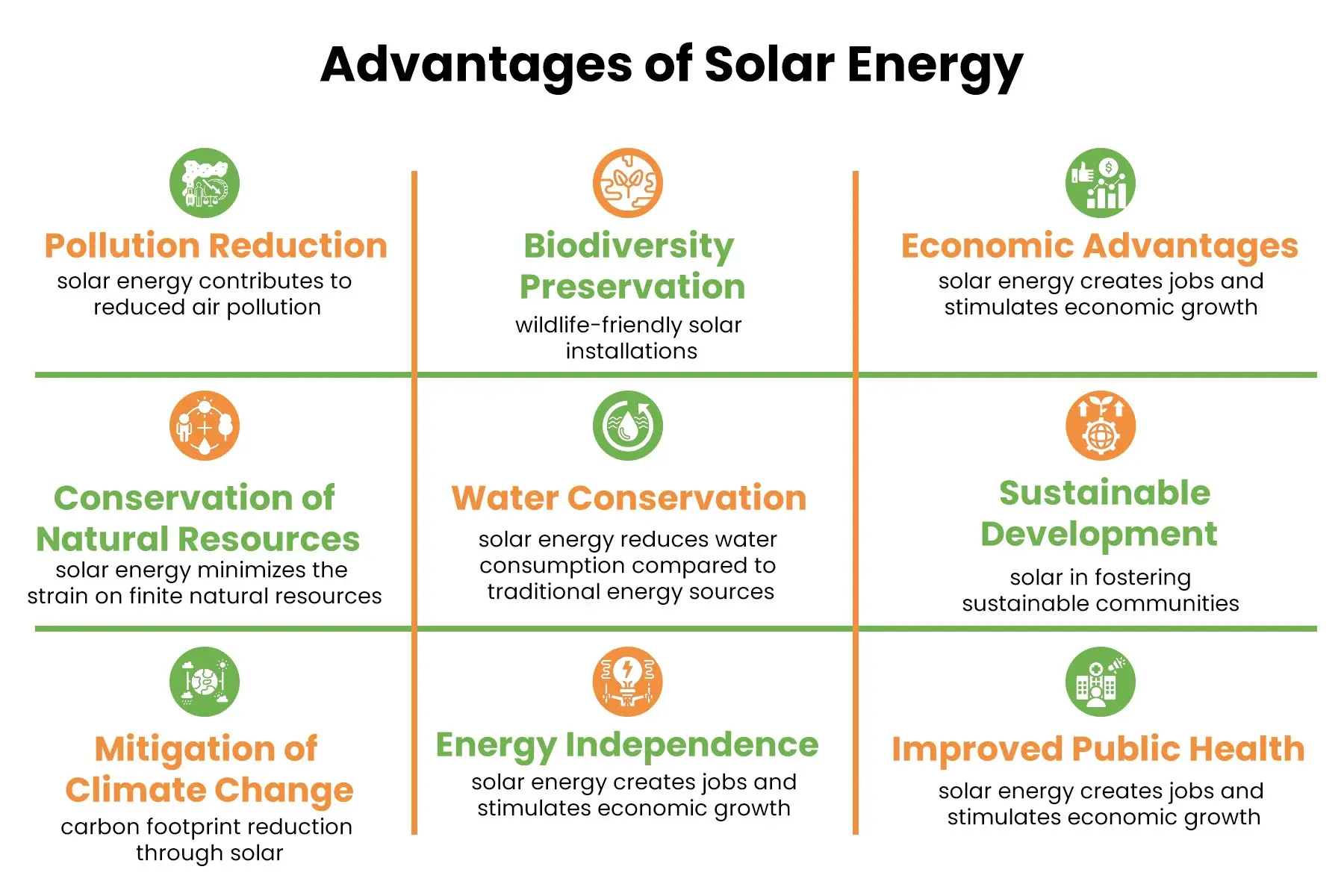

Our team companions with neighborhood communities throughout the Northeast and past to provide clean, economical and dependable power to promote healthy and balanced communities and maintain the lights on. A solar or storage project delivers a variety of advantages to the area it serves. As modern technology breakthroughs and the price of solar and storage space decline, the financial benefits of going solar remain to increase.Support for pollinator-friendly environment Environment repair on polluted websites like brownfields and landfills Much needed shade for livestock like lamb and chicken "Land banking" for future agricultural usage and dirt high quality improvements Due to environment modification, severe weather is coming to be more constant and disruptive. As an outcome, property owners, companies, areas, and utilities are all ending up being more and more thinking about securing energy supply options that provide resiliency and energy safety.

Ecological sustainability is one more key driver for businesses spending in solar power. Several business have robust sustainability objectives that consist of lowering greenhouse gas emissions and making use of much less sources to help minimize their impact on the all-natural environment. There is a growing seriousness to attend to environment modification and the pressure from customers, is reaching the leading levels of companies.

Little Known Facts About Simply Solar Illinois.

As we come close to 2025, the integration of photovoltaic panels in industrial projects is no longer simply an option yet a critical requirement. This blogpost looks into exactly how solar energy works and the complex advantages it gives commercial structures. Photovoltaic panel have actually been used on household buildings for lots of years, yet it's only lately that they're ending up being much more common in commercial building.

It can power illumination, heating, a/c and water home heating in industrial buildings. The panels can be installed on roofs, car park and side lawns. In this post we talk about exactly how solar panels work and the benefits of utilizing solar power in industrial buildings. Electricity prices in the U.S. are raising, making it a lot more pricey for companies to operate and extra challenging to prepare ahead.

The United State Energy Info Management anticipates electric generation from solar to be the leading source of growth in the united state power industry via the end of 2025, with 79 GW of brand-new solar capability forecasted ahead online over the next 2 years. In the EIA's Short-Term Energy Expectation, the company claimed it expects renewable energy's overall share of electrical power generation to climb to 26% by the end of 2025

Facts About Simply Solar Illinois Revealed

The photovoltaic or pv solar cell takes in solar radiation. The wires feed this DC electricity into the solar inverter and transform it to alternating power (AIR CONDITIONER).

There are numerous methods to keep solar power: When solar power is fed into an electrochemical battery, the chemical reaction on the battery elements maintains the solar energy. In a reverse reaction, the present leaves from the battery storage for usage. Thermal storage utilizes tools such as liquified salt or water to keep and take in the warmth from the sunlight.

Solar panels considerably minimize energy expenses. While the initial investment can be high, overtime the cost of setting up solar panels is recovered by the money saved on electrical energy costs.

Simply Solar Illinois Fundamentals Explained

By mounting photovoltaic panels, a brand reveals that it cares about the environment and is making an effort to decrease its carbon footprint. Buildings that depend completely on electrical grids are susceptible to power failures that occur during bad weather or electrical system malfunctions. Photovoltaic panel set up with battery systems allow business buildings to continue to function during power interruptions.

The Best Strategy To Use For Simply Solar Illinois

Solar power is just one of the cleanest types of energy. With long-lasting service warranties and a manufacturing life of approximately 40-50 years, solar investments go to this site add substantially to environmental sustainability. This change towards cleaner power sources can result in more comprehensive economic advantages, including reduced climate change and environmental degradation expenses. In 2024, house owners can take advantage of federal solar tax obligation rewards, allowing them to offset virtually one-third of the acquisition rate of a solar system via a 30% tax credit.

Report this page